What is a PAMM account? Investment in PAMM accounts

According to Wikipedia PAMM abbreviation means Percent Allocation Management Module. From the perspective of a trader the PAMM account is no different from an ordinary trading account. In this account an average trader (but he is called as the manager of the PAMM account) operates with the same trading terms and receives the same income.

However the PAMM system allows investors to put money in it and thereby to take part in the distribution of profit. Moreover, the amount of profit you get is proportional to your equity participation in the PAMM account.

Thus, unlike an ordinary trading account the PAMM account consists of two parts:

- Manager 's own funds

- Funds of investors

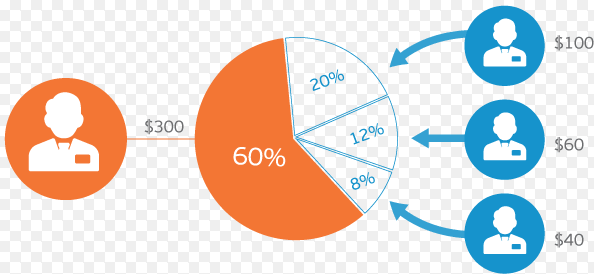

Together they compose the overall capitalization of PAMM accounts. It is this amount showing in the trading platform and a manager carries on trade for this amount. In the schematic investments in PAMM accounts are as follows.

In the figure one can see that the part of profit obtained by investors (there can be an unlimited number of them) is paid back to the manager; it is a reward for his work.

One should invest in the PAMM account for reasons such as:

- You are free to decide in which account to invest;

- There is all the necessary information for the decision (account history with detailed statistics: schedule of revenues, etc.) ;

- High yield with moderate risk (you can get a portfolio with profit of 100% per year with minimal risk);

- The possibility to constantly control your investments.

For what PAMM accounts are intended.

In order to understand what the PAMM account is, you need to know the purpose of the PAMM system, which is intended to technical simplification of cooperation between the trusted trader and investor. A broker providing investment services in the PAMM account takes all the responsibility for the technical aspect.

The PAMM system serves to control and to account trade, investment, gained profit and distribution of shares between the manager and investors automatically.

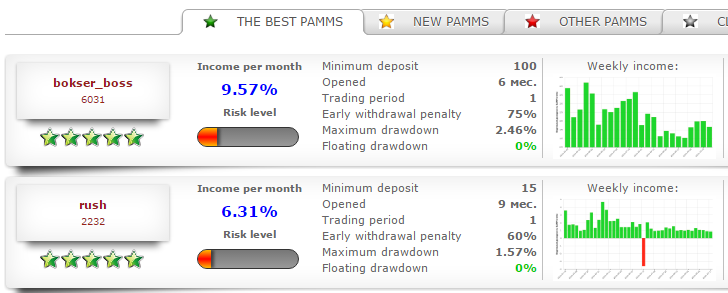

As a rule, any PAMM broker offers detailed monitoring of all the PAMM accounts, suitable rating to select the best managers, distribution of profits and so on. On our website you can see the rating of the PAMM accounts of PrivateFX and it is possible to evaluate work progress of each trader in a graphic form as well as to estimate profitableness and risk of the PAMM account.

The one important advantage of PAMM systems is that a trader does not have an access to the investor's money. He can only lose this money, but taking into account the fact that not only investor's money but the money of traders are involved in the trade, the trader is definitely not interested in losing this money. That is why traders are seeking to generate high and regular income.

The more stable the manager's work is, the more investors he will attract to his PAMM account, because people will most likely trust their money to the manager with lots of successful trades.

The PAMM account for investors.

For investors the PAMM account is a possibility to earn money by joining it. As a result of a trade, the received profit will be divided proportionally, according to the amount of money invested. That is how everyone can make profits trading forex without any specialized training just by investing money in the PAMM accounts.

For investors the PAMM account is a possibility to earn money by joining it. As a result of a trade, the received profit will be divided proportionally, according to the amount of money invested. That is how everyone can make profits trading forex without any specialized training just by investing money in the PAMM accounts.

When an investor puts his money in the PAMM accounts, he does not buy a pig in a poke. The investor has got access to the whole history of manager's work, full statistics of incomes, drawdowns, etc.

Therefore, when you choose a PAMM account, you can weigh all pros and cons and invest your money in the account that will most likely be profitable in the nearest future. In order to make your investing successful, you should learn about how to choose an appropriate PAMM account.

The advantages of the PAMM account for investors:

- You don't need specialized knowledge and experience in trading (because your money is managed by an experienced trader).

- The manager has his own funds, so traders are not allowed to trade randomly.

- The manager doesn't have direct access to clients' money and therefore he can't withdraw funds of his clients.

- You can both invest your money and withdraw it from your PAMM account at any time (but not during the trading period).

- Diversification of investments by putting money in different PAMM accounts.

- The full history of incomes of the PAMM account is available, as well as history of drawdowns, risks and other important statistics.

- You can invest even $10. Though, the majority of managers set the minimal possible investment as $100.

- If a loss appears, the investor will not pay any remuneration to the manager.

The PAMM accounts for managing traders.

The PAMM accounts for managing traders.

The PAMM account gives a trader an opportunity to increase incomes substantially through remunerations to investors.

Therefore, lots of advantages exist both for investor and for trader – investors give their money to the experienced trader and get their incomes. Traders, for their part, are rewarded for their successful trading.

The advantages of the PAMM account for traders

- Extra profit due to reward of investors. This profit can be several times higher than the one that a trader would receive by selling only their own money.

- Specifying of trading conditions at one's pleasure (they are provided in the offer of the PAMM account)

Key concepts of the PAMM accounts

Trading period

A manager while planning a transaction should adhere to certain limits that are comparable to the risks of its trading strategy. Therefore some restrictions are imposed on the withdrawing of the invested money. As a rule, a certain trading period is set for each PAMM account.

It may be useful to elaborate on this point a bit further. For example the price changed from an open transaction, the investors decided to withdraw money and increased drawdown, which resulted in Margin Call and fixation of loss. Despite the fact that while planning the transaction a manager considered the possibility of the drawdown.

Thus, the trading period is a kind of protection for manager's trading strategy; it allows better planning of transactions.

The offer

Any PAMM account has its own terms, which are allowed within the PAMM system. The main terms are stipulated in the offer of the PAMM account. They include trading period, the percentage of manager's reward, responsibility and so on.

Occasionally one PAMM account can have a few offers. As a rule, managers set a lower reward percentage depending on the amount of investments.

Rollover

Different PAMM brokers may propose different definitions of the rollover, but its main purpose is to determine the time of money distribution between the manager and investors. Each PAMM account has its own rollover schedule (usually several times a day) and applications of investors are handled during it (replenishment, early withdrawal, profit distribution, etc.)

Do not confuse the notion of rollover, and the trading period, as a rule rollover frequency is usually set to hours, while trading period lasts up to weeks or months.

Conclusions.

The PAMM accounts provide an excellent opportunity to earn extra income in Internet, investing in successful managers. Comparing with other types of high-yield investments the PAMM will always have top priority in view of the above-mentioned benefits.